One of the Big Four UK banks partnered with the Responsible AI Institute (RAI Institute) to comprehensively validate its GenAI system. Through the RAISE Pathways AI Verification Badging Program, the bank gained three critical credentials, transforming its approach to AI governance, cost management, and environmental sustainability, earning recognition as a leader in responsible AI innovation.

Customer Background

As a major financial services provider, this UK-based bank serves millions of retail and business customers across the country. It has embraced Generative AI to enhance customer experience, including deploying a Travel Insurance Knowledge Assistant that helps customers understand coverage terms and navigate complex policies.

Facing increasing pressure to prove its AI systems are safe, sustainable, and fiscally responsible, the bank turned to external verification to benchmark its AI system’s performance and regulatory alignment.

Customer AI Environment

- Cloud Infrastructure: Amazon AWS (Bedrock)

- Models Tested: GPT-4o, GPT-4o-mini, Llama 3.2

1B & 3B, Mistral-7B, Phi-3.5 - Optimization Layer: Trustwise Optimize:ai

- Team Size: 75+ AI scientists and architects

Verification Standards Applied:

- NIST AI RMF, ISO/IEC 42001, OWASP

- FinOps Foundation + TBM Council

- ISO/IEC 21031 SCI standard

Key Challenges

- AI Cost Transparency: Rising token consumption created budget and efficiency concerns.

- Carbon Impact: ESG targets required formal carbon emissions tracking and optimization.

- Audit and Compliance: Needed third-party validation for regulators and internal review.

Solution

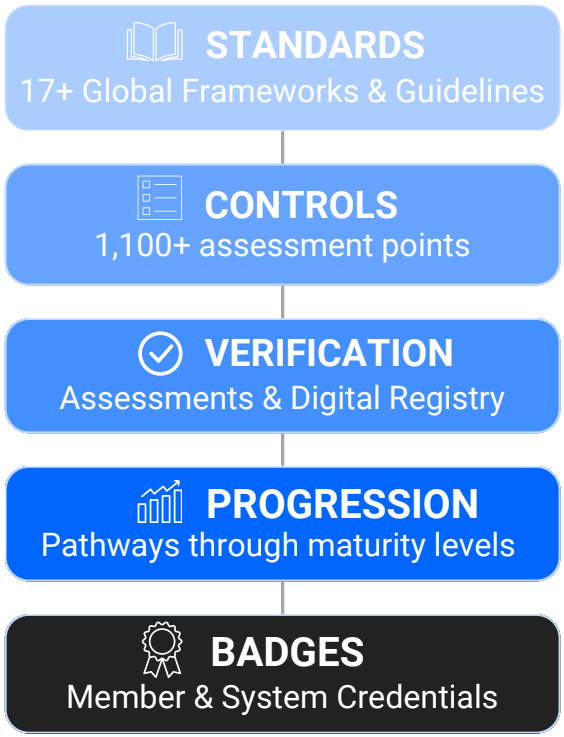

The bank used the RAISE Pathways™ platform to complete a structured self-assessment and verification process, earning three AI Verification Badges:

- Generative AI Foundations Badge

- 75 controls focused on transparency, bias mitigation, governance, and LLM security

- Mapped to NIST AI RMF, ISO/IEC 42001, and OWASP

- Sustainable AI Verification Badge

- 25 controls focused on energy use and emissions per AI workload

- Based on ISO 21031 and SCI standards

- AI Cost Efficiency Verification Badge

- 25 controls focused on total cost tracking and workload optimization

- Aligned with FinOps and TBM Council practices

Implementation rates ranged from 72% to 87.3% across the three badge categories.

Implementation Rate: 74%

Implementation Rate: 87.3%

Implementation Rate: 72%

Outcomes

The bank saw measurable impact across multiple priorities. In terms of trust and governance, it established a transparent framework that earned recognition from regulators and boosted customer confidence in its GenAI systems. Verified practices helped reduce compliance risk and made audit preparation faster and more efficient.

On the cost side, the bank reduced its Total Cost of Ownership by 38%. It maintained model performance while cutting operational expenses, and clearly demonstrated effective resource planning to senior stakeholders.

The environmental results were equally strong. By adopting carbon-aware computing schedules, the bank reduced the carbon intensity of its AI workloads by 66%. These improvements aligned with internal ESG targets and helped position the bank as a leader in environmentally responsible AI.

The effort also strengthened the bank’s position in the market. It gained a first-mover advantage by becoming one of the earliest institutions in its sector to receive verified badges for responsible AI. Internally, the process created a scalable and reusable framework for future GenAI initiatives. Externally, each badge is now recorded in the Responsible AI Registry, giving stakeholders public, evidence-based assurance of the bank’s commitment to responsible AI practices.

About RAI Insitute

Since 2016, Responsible AI Institute (RAI Institute) has been at the forefront of advancing responsible AI adoption across industries. As an independent non-profit organization, RAI Institute partners with policymakers, industry leaders, and technology providers to develop responsible AI benchmarks, governance frameworks, and best practices. RAI Institute equips organizations with expert-led training and implementation toolkits to strengthen AI governance, enhance transparency, and drive innovation at scale.

Current and past members include AWS, Ally Bank, IBM, KPMG, AMD, ATB Financial, BCG, Genpact, and the U.S. Department of Defense, as well as academic partners from MIT, Cambridge, Harvard, and UT Austin. Discover membership options.